Introduction to MSTY

What Is MSTY?

MSTY is a publicly traded company that has gained attention among income-focused investors for its dividend performance. Although many investors look at earnings and growth, MSTY’s dividend history plays a significant role in assessing whether it’s a reliable long-term investment. Understanding how the company distributes profits helps you gauge its stability and shareholder-friendly approach.

Why Investors Care About Its Dividend History

Dividend history tells a story—one that investors can use to understand how dependable a company has been. A strong and consistent dividend track record often suggests solid financial management, steady cash flow, and long-term commitment to rewarding shareholders.

Understanding Dividend History

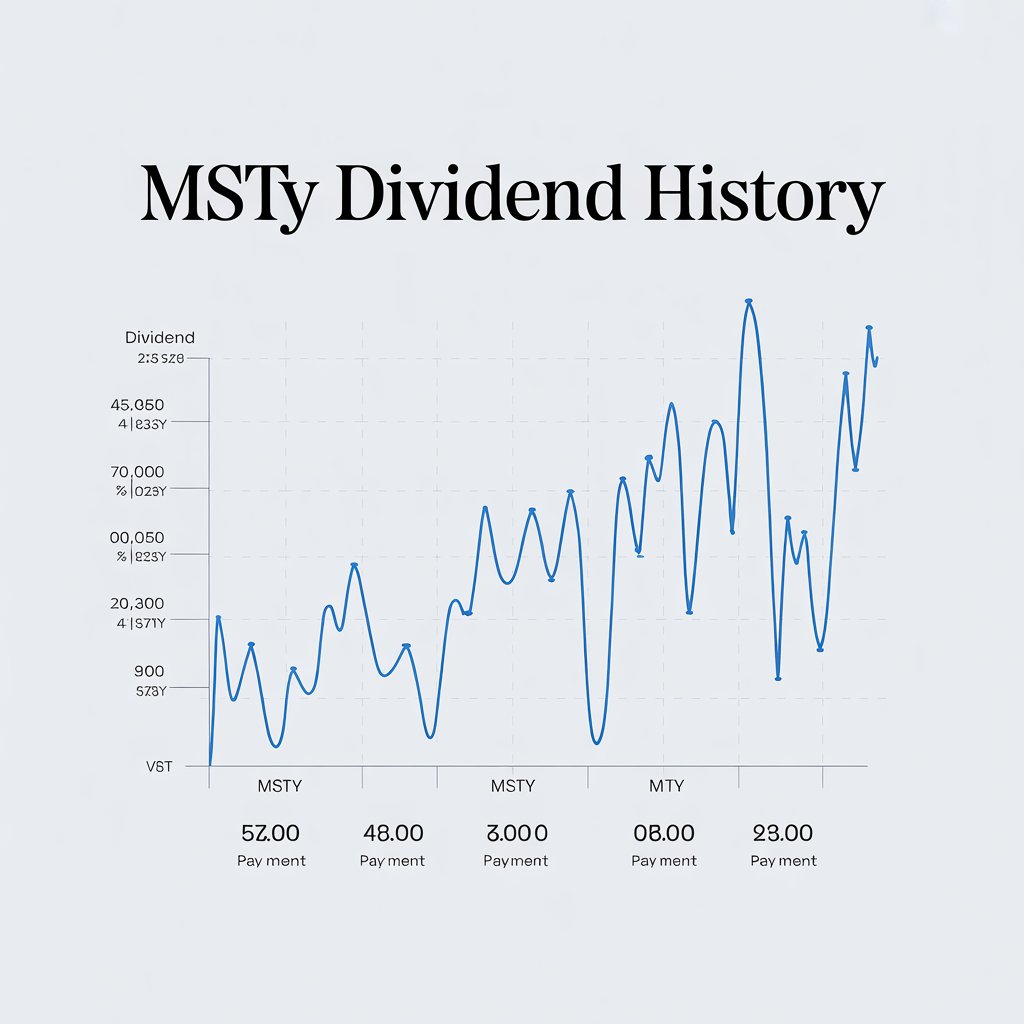

What Dividend History Shows

A dividend history outlines the timeline of dividend payouts, their amounts, and how frequently they were issued. This allows investors to evaluate whether the company’s dividends are growing, stable, or fluctuating.

Importance of Tracking Dividends Over Time

Tracking the dividend performance gives insights into:

- Company profitability

- Financial stability

- Long-term management strategy

- Shareholder confidence

If dividends are rising steadily, it’s a strong indicator of company health.

MSTY Dividend Overview

Annual Dividend Payouts

MSTY’s annual dividend payouts reflect the company’s earnings capacity and distribution policy. Investors looking for stability often review the yearly payout to determine whether MSTY maintains consistency or adjusts dividends based on performance.

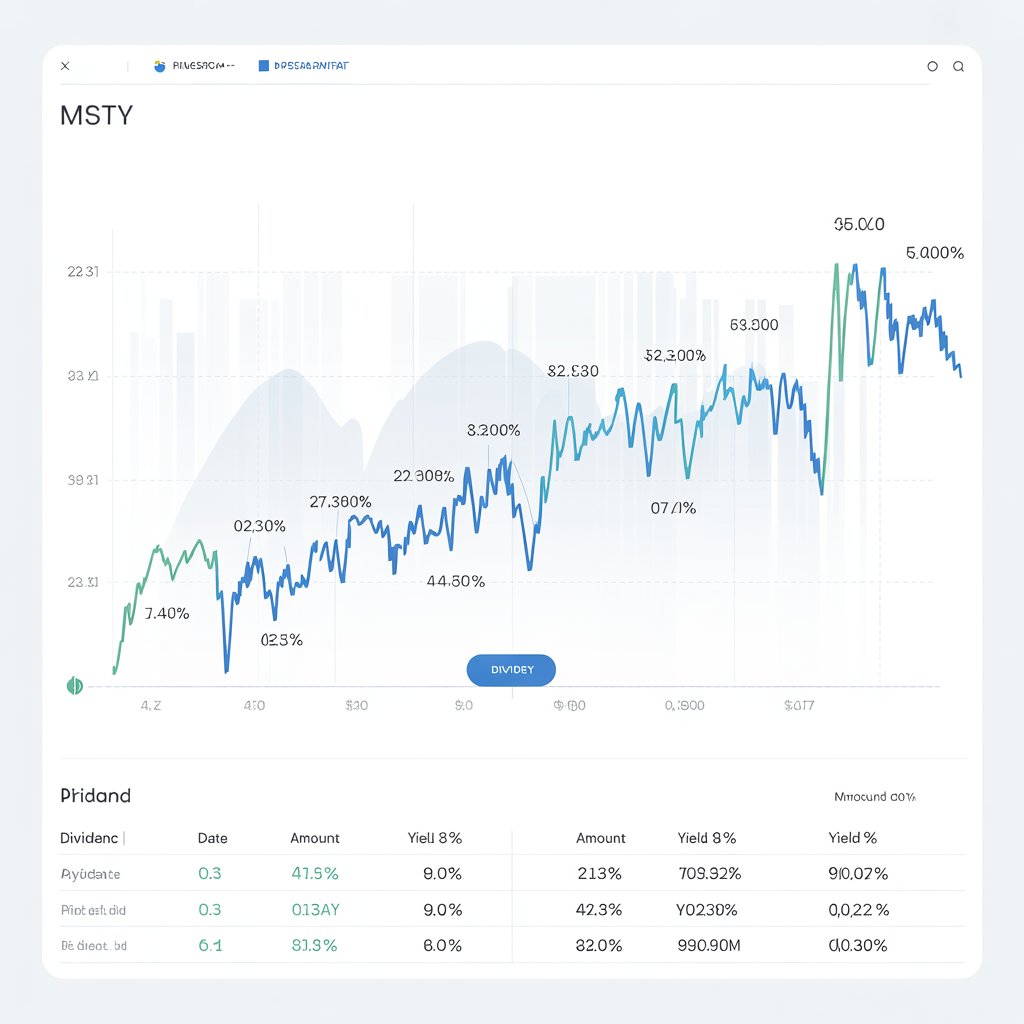

Dividend Yield Trends

Dividend yield helps you understand how much return you’re getting relative to MSTY’s stock price. Tracking yield trends over time shows whether higher yields are due to increased payouts or falling share prices.

Factors Influencing MSTY’s Dividend Decisions

Several factors may impact how MSTY determines dividends:

- Profit margins

- Available cash reserves

- Debt level

- Economic conditions

MSTY Dividend Growth

Historical Growth Patterns

A growing dividend is often a sign of strong performance. MSTY’s dividend history may show incremental raises, signaling financial health and a commitment to long-term investors.

Consistency and Stability in Payouts

Investors prefer consistent dividends over volatile ones. Stability means the company is predictable, making MSTY appealing to retirees and income-focused portfolios.

How MSTY Compares to Industry Peers

Comparing MSTY with similar companies helps determine whether it’s competitive. If its dividend growth outpaces the industry, that’s a huge plus for investors.

Key Dates in MSTY Dividend History

Declaration Date

The board announces its decision to pay a dividend. This is usually the first signal investors get.

Ex-Dividend Date

To receive the next payout, investors must buy shares before this date.

Record Date

On this date, MSTY finalizes the list of shareholders eligible for the dividend.

Payment Date

This is when the dividend actually hits your account—always a good day for investors!

What Influences MSTY’s Dividend Policies

Company Earnings

Dividends are funded by profits. Strong earnings often translate to strong dividends.

Cash Flow Strength

Healthy cash flow ensures MSTY can support dividends even during slow earnings periods.

Long-Term Strategic Goals

If MSTY focuses on expansion, dividends may stay flat to retain capital. If the goal is to reward shareholders, dividends may rise steadily.

Is MSTY a Good Dividend Stock?

Pros of Investing in MSTY for Dividends

- Potential for long-term income

- Possible dividend growth

- Strong historical payouts

- Reliable track record

Potential Risks to Consider

- Dividend cuts during downturns

- Market volatility affecting yield

- Shifts in company strategy

How to Analyze MSTY’s Dividend Strength

Dividend Payout Ratio

This ratio shows what percentage of earnings go to dividends. A stable payout ratio means sustainable dividends.

Dividend Coverage Ratio

This tells how easily MSTY can cover its dividend obligations with earnings. Higher coverage = safer dividends.

Total Return Potential

Dividends + stock price appreciation = total return. This helps investors evaluate overall growth potential.

Future Outlook for MSTY Dividends

Expected Trends

If MSTY continues strong business performance, dividend increases may be likely.

Analyst Predictions

Market analysts often forecast dividend behavior based on earnings reports and financial performance.

Market Conditions That Could Affect Dividends

Inflation, interest rates, recession risks—all can influence MSTY’s future payouts.

How to Invest in MSTY for Dividend Income

Beginner Tips

- Research the company’s past dividends

- Evaluate payout and coverage ratios

- Diversify your dividend portfolio

Strategies for Maximizing Dividend Returns

- Reinvest dividends

- Buy during dips

- Focus on long-term holding

Conclusion

MSTY’s dividend history offers valuable insights into its stability, profitability, and long-term potential as a dividend-paying stock. Whether you’re a new investor or an experienced one, understanding dividend trends helps guide smarter decisions. MSTY’s past performance showcases its commitment to rewarding shareholders, but always evaluate future prospects and market conditions before investing.

more news : Gut Drops Breakthrough: 10 Life-Changing Benefits

FAQs

1. Does MSTY Have a Strong Dividend History?

Yes, MSTY has shown a consistent and reliable dividend record over time.

2. How Often Does MSTY Pay Dividends?

Most dividend-paying companies distribute quarterly, but always verify the current schedule.

3. What Can Affect MSTY’s Dividend Payouts?

Earnings, cash flow, debt levels, and market conditions all influence payout decisions.

4. Is MSTY Good for Long-Term Dividend Investing?

If you value stability and potential growth, MSTY can be a solid long-term pick.

5. How Can I Track MSTY’s Dividend Announcements?

You can follow financial news platforms, stock market apps, or MSTY’s investor relations page.